As the Federal Reserve keeps buying more and more government debt, with no prospect of reducing its holdings unless and until the government gets its house in order, bond yields are likely to rise, despite Fed buying, because yields also reflect inflation premiums. The prospect of inflation will rise as the Fed monetizes the debt. We would then see yields rising accompanied by firm prices of commodities and metals.M. Rozeff, Geithner Says U.S. Insolvent

The inflationary participation by the Fed, which postpones the inevitable fiscal decisions of the government, harms all holders of fixed-dollar assets and all those whose receipts of dollars are fixed and lag behind the Fed’s production of new dollars. In addition and more importantly, the inflation sets in motion another boom-bust cycle.

Monday, January 10, 2011

Michael S. Rozeff on Monetizing the Debt

A few reasons to buy gold and silver:

Subscribe to:

Post Comments (Atom)

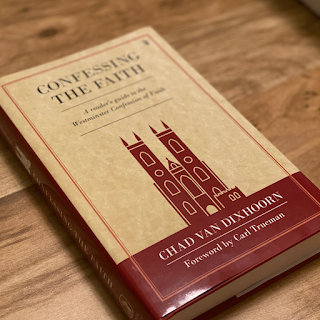

WCF Chapter One "Of Holy Scripture" Sunday School (Sept.-Oct. 2021)

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

January 12, 2012 Update: The old link no longer works. The old link is still below but the new leak is right below the old link. Thanks to t...

-

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

No comments:

Post a Comment