Black Conservative Leader Challenges Sharpton, Morial, Fauntroy to Defend in Debate Charges Tea Party is Racist | CNSnews.com

Chaos in government. Tens of thousands of angry protesters in the streets. Schools closed. Yes, Wisconsin looks a lot like Egypt this week. But while Arabs are fighting to end extraordinary overreach by government, Wisconsin union protesters are fighting to preserve it.Read the rest of the column here.

Yeah, the list of student loan abuses is just that long.

Yeah, the list of student loan abuses is just that long. It also presumes that students, some of whom owe an excess $200,000, can pay the interest and eventually the principal. The federal government’s assumption of all student loans as part of the Obamacare package has not only added to an insurmountable deficit but has put most loan recipients into perpetual government clientage.Read "Federal Student Loans Are Detrimental to America"

In this report, I am making a point: the country is headed for a fiscal disaster, and there is no broad-based political movement inside the country to put on the brakes. The train is headed for the collapsed trestle, and it is speeding up. The President as the engineer is talking about slowing the train a little, but he has not yet put on the brakes.Read the rest here.

No one will put on the brakes.

People at the bottom of the income scale struggle more as these prices rise, of course, because a larger share of their spending is on such essentials.To raise prices or not to raise prices:

These companies are constantly walking a tightrope on how far do I go,” said Jack Russo, a consumer goods analyst at Edward Jones. “Do I offset with price or other cost cuts, or do I just take it and have it eat into my profit margins?”

Restaurants, which resisted raising prices to keep customers coming through the doors last year, are also fretting. They may take other steps too, like lowering thermostats, shrinking packaging or reducing portion sizes to minimize the sticker shock.

This year, “you’re going to have to raise prices to stay in business,” said Len M. Steiner, owner of the Steiner Consulting Group, which works with restaurant companies on ingredient purchasing.

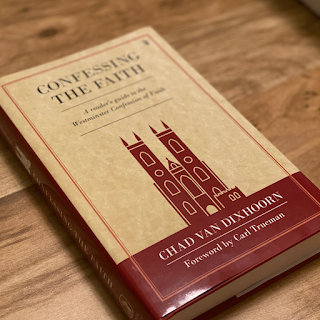

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...