IntroductionState and Local Sales Taxes in 2012 || The Tax Foundation

Retail sales taxes are a transparent way to collect tax revenue. While graduated income tax rates and brackets are complex and confusing to many taxpayers, the sales tax is easier to understand: people can reach into their pocket and see the rate printed on a receipt.

Less known, however, are the local sales taxes collected in 36 states. These rates can be substantial, so a state with a moderate state sales tax rate could actually have a very high combined state-local rate compared to other states. This report provides a population-weighted average of local sales taxes in each state in an attempt to give a sense of the statutory local rate for each state.

Friday, February 17, 2012

State and Local Sales Taxes in 2012

From the Tax Foundation blog:

Subscribe to:

Post Comments (Atom)

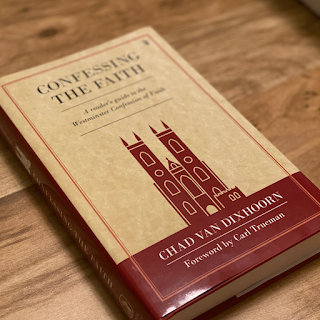

WCF Chapter One "Of Holy Scripture" Sunday School (Sept.-Oct. 2021)

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

January 12, 2012 Update: The old link no longer works. The old link is still below but the new leak is right below the old link. Thanks to t...

No comments:

Post a Comment