One thing that I learned about law is that sometimes it is created as a reaction to recent events that cause uproar. Many times the politicians feel that they have to do something to correct some social or political ill. After all, the politicians are here to help us, right? The American Recovery and Reinvestment Act of 2009 was created as a response to the economic crisis of 2008 and the perceived threats of the future. The Emergency Economic Stabilization Act of 2008 was passed because those who supported it thought it was going to prevent a depression.

What marvelous foresight! Not only are we entering Great Depression level unemployment, neither of these packages seemed to help.

When law is made in this way (rushed, with unclear objectives, and misunderstands problems, often having unintended effects) sometimes it can be disastrous for those it is intended to help. The Sarbanes-Oxley Act of 2002 is such an act. The SOA was a response to the scandals of Enron, Tyco, and Worldcom in the early 2000s. Many of its supporters said it would “restore investor confidence” in U.S. Financial Markets.

I have my own reasons for disagreeing.

First, the SOA had an unintended effect: it drove business outside of the United States. In fact, the number of American companies deregistering from the U.S. stocked exchange tripled a year after the law was passed. Also, I think that the SOA by its very nature couldn’t “restore investor confidence” in U.S. companies. After all, the companies that were problematic are essentially out of business, or at least took a hit. This is the natural way the free-market chooses what a priority is: Investors choose away from bad firms.

Subscribe to:

Post Comments (Atom)

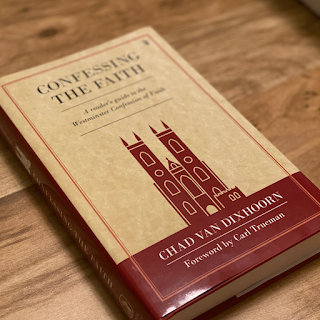

WCF Chapter One "Of Holy Scripture" Sunday School (Sept.-Oct. 2021)

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

January 12, 2012 Update: The old link no longer works. The old link is still below but the new leak is right below the old link. Thanks to t...

-

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

No comments:

Post a Comment