Tuesday, November 30, 2010

Video: Social Security Scam Robs Elderly By Convincing Them They Are Dead

Talk about sticking it to the elderly. Who is afraid of a default on social security when there are people in the world scamming old people like this?

(For those who don't know, The Onion is a satirical news site)

Video: '9/11 Conspiracy Theories Ridiculous' - Al Qaeda

It's been a while seen I've looked into the so-called 9/11 truth movement - 2007 to be exact. As of right now, I'm not convinced of what this movement argues: that 9/11 was an inside job.

What you must say - in order for me to believe that "individuals within the United States government may have been either responsible for or knowingly complicit in the September 11 attacks" as Wikipedia puts it - or rather what you must do is define what you mean by "inside job." If you mean that the Bush administration coordinated the entire thing, then I'm not on your side. However, if you mean that foreign policy as advocated by Washington insiders lead to the events on September 11th, 2001, then sure, I'm on your side. I'm a big believer in blowback; I'm not big on.....

Truth is always important and in all ages. But right now, there's enough evidence that government corruption exists and has been existing for some time now. I can sleep at night not accepting the truth of 9/11. Any explanation for 9/11 is a bad one (if product of foreign policy, then bad; if product of Bush Administration, then it's still bad), and the resolution of contradictory explanations and accounts is not top priority right now.

...Oh yea...The Onion produced a classic in the above video. "How would you like it if you spent two months sleeping in a mountain cave, sleeping on rocks, planning something very special only to have someone take the credit from you?"

August 2011 Update:

I find the 9/11 truth movement more credible now. Better late than never.

Monday, November 22, 2010

H.L. Mencken on Democracy

Sunday, November 21, 2010

Overdose: The Next Financial Crisis (Film)

According to the Facebook Fan Page for the Movie, "Overdose is the story about the greatest economic crisis of our age - the one that awaits us."

Saturday, November 20, 2010

Anarchy and Christianity

"Jacques Ellul blends politics, theology, history, and exposition in this analysis of the relationship between political anarchy and biblical faith. On the one hand, suggests Ellul, anarchists need to understand that much of their criticism of Christianity applies only to the form of religion that developed, not to biblical faith. Christians, on the other hand, need to look at the biblical texts and not reject anarchy as a political option, for it seems closest to biblical thinking."(Italics added)The notion that anarchy is closest to biblical thinking has been reiterated and expounded upon in the 2001 essay Biblical Anarchism by Stephen W. Carson. I thoroughly recommend it. In fact, one should listen to this brief 12-minute MP3 (The Biblical Prophet: He Told It Like It Is by the late Robert LeFevre) before reading the essay to get a good understanding of where Carson is coming from.

J.R. Hummel on The Death of the Welfare State

J.R. Hummel on "Pay-As-You-Go"

Friday, November 19, 2010

Video:The BLOWBACK SYNDROME: Oil Wars and Overreach

According to Merriam-Webster blowback is:

an unforeseen and unwanted effect, result, or set of repercussions

Ron Paul on Money and Our Economy

To listen to the entire article of which this passage was excerpted from, click here.

Hennacy on Anarchism

Thomas Woods on Bipartisanship

Monday, November 15, 2010

Video: Quantitative Easing Explained

This video is spreading like wildfire! Watch it and see why!

An excerpt from this brilliant conversation:

Man Creature: The deflation is when the prices of the things we buy go down?

Woman Creature: Isn't this good? Doesn't this mean the people can buy more of the stuff?

MC: Yes, but the Fed said this was bad. Especially during the recession.

WC: So they think that during the recession, when the people have less money to buy the stuff, they think its bad that the prices go down?

MC: Yes, the Fed would rather have the inflation.

WC: So why does the Fed think we have the deflation?

MC: Because the CPI said so.

WC: But aren't the food prices higher than a year ago?

MC: Yes.

WC: Aren't the gas prices higher than a year ago?

MC: Yes.

WC: Aren't the health care costs higher than a year ago?

MC: Yes.

WC: Aren't the tuition prices higher than a year ago?

MC: Yes.

WC: Aren't the taxes higher than a year ago?

MC: Yes.

WC: Aren't the subway fares higher than a year ago?

MC: Yes.

WC: Aren't the stock prices higher than a year ago?

MC: Yes.

WC: Aren't the bond prices higher than a year ago?

MC: Yes.

WC: So what is deflating right now?

MC: The only thing that is deflating, that I can see, is the Fed's credibility.

Thomas Sowell on Congressional 'Gridlock'

But, as Thomas Sowell notes, gridlock is what prevents the worst possible bills from coming into existence. Well, except for Obamacare. You know, the bill that regulates things that has absolutely nothing to do with health care at all (I'm thinking of the regulation on gold. Why Gold? Why in a health care bill?)

Other conservative commentators have noted that our "founders" did not want an "efficient" government. They wanted a government with a little gridlock so that government could not rapidly expand. Nevertheless, pundits complain.

Thomas Sowell gives a history lesson on Congressional 'Gridlock'. Read on.

Friday, November 12, 2010

Alan Greenspan on Supply & Demand Applied to Money

Alan Greenspan on the Welfare State

"Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support the wide variety of welfare schemes. A substantial part of the confiscation is affected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale." ~Alan Greenspan

Tuesday, November 9, 2010

Rothbard Thinks Social Security is a Ponzi Scheme, Too

Thus, most people think that the Social Security Administration takes their premiums and accumulates it, perhaps by sound investment, and then "pays back" the "insured" citizen when he turns 65. Nothing could be further from the truth. There is no insurance and there is no "fund," as there indeed must be in any system of private insurance. The federal government simply takes the Social Security "premiums" (taxes) of the young person, spends them in the general expenditures of the Treasury, and then, when the person turns 65, taxes someone else to pay the "insurance benefit." Social Security, perhaps the most revered institution in the American polity, is also the greatest single racket. It's simply a giant Ponzi scheme controlled by the federal government. But this reality is masked by the Social Security Administration's purchase of government bonds, the Treasury then spending these funds on whatever it wishes. ~Repudiating the National Debt

Rothbard on Hamilton's "Debt as National Blessing" Argument

Video: Reversal Tuesday, jobs, Fed critics, Bernanke, SchiffRadio.com

Despite the fact that last week, when the world received news that the Federal Reserve would be rejecting sound economic sense (for the umpteenth time) and begin QE2 (or the second dose of Quantitative Easing) to stimulate the economy, it is great to know that the world is waking up to the disaster of Federal Reserve monetary policy. Japan, China, Germany, and a host of other leaders, and even critics within the Federal Reserve itself, are against the new injection of money into the economy - and rightly so!

In this latest video by Peter Schiff, he criticizes the Fed and humorously points out their only solution to crises: inflate a burst bubble by printing up more money and lowering interest rates. Schiff addresses the nonsense:

Didn't we just blow two bubbles? According to Ben Bernanke we now need a new stock market bubble to cure the recession caused by the housing bubble which was created because the Fed tried to cure the recession caused by the bursting of the previous stock market bubble. So is this it? Is this all they know? Serial bubble blowing forever creating bubbles?Because people within the Fed are distancing themselves from Ben Bernanke, I must say that the genius behind this new plan is looking lonely in his decision, and he is looking quite clueless. But the world isn't. The other good news is that concerns about inflation may bring a rise to new gold standard. This is a step in the right direction. Next, we Austrians hope, 100 percent reserve Banking.

Monday, November 8, 2010

Sunday, November 7, 2010

Size (Of the Government) Matters

When it comes to the size of government, smaller is better: better for the economy; better for the taxpayer; better for freedom.

What politicians decide will be the size and scope of the government is of great importance to our economic recovery. It would have helped two years ago—when Obama first got into office—if we had discussions about what to cut. But since we didn’t we are now more in debt because of government deficit financing and other big government ventures.

If we shrunk the size of the government, which means unproductive jobs—and all government jobs are unproductive because they drain the private sector—are lost, labor will be free to pursue productive jobs in the private-sector. Moreover, the taxpayer would not be on the hook for the excessive benefits government workers receive that have no parallel in the private sector.

The Cato Institute has been very helpful in outlining which Departments—yes whole departments—of the U.S. Government to cut. They proposed 15 different departments that could be cut in a very short document. This short work is important because Democrats always stick the same question to Republicans, "Well, what would you cut?", as sort of a defeater for Republicans; and when they can't, and usually don't answer, they get big Democratic eggs on their faces (The non-answers, of course, don't justify the persistence of Democrats keeping projects like Social Security and Medicare publicly-funded; nor does it justify expanding the size and scope of government). When Republicans do answer, it is usually something small; something that would hardly fix anything. (I am reminded of the response a few weeks ago that they will cut spending to 2008 levels, as if that is hardly enough!)

If I were a Republican, I'd begin where everyone is criticizing me at: Defense Spending. That means immediately ending the wars, closing the 100+ overseas bases, and, in a Jeffersonian move, shrinking the size of the military as well. Then I'd move on to privatizing Social Security and Medicare. As for cutting out American's unemployment insurance, I would not. Unemployment insurance is just a fraction of the budget. It can stay for a while.

I'd also cut those 15 departments that the Cato Institute recommended. And while many people will hurt short term, because of the release of the thousands of government and military employees, overall the economy will get better just like it did after World War II ended. For those who don't know, the Great Depression ended because government cut spending, and the year after we had the most productive year in all of U.S. history.

The guys at Cato also have produced a book called “Downsizing Government” that is now available on their website and is free for a limited time only. Also, they have a website of the same name, which serves as a "department-by-department guide to cutting the federal government's budget," that I highly recommend.

It is worthy to note that "Big Government" in itself is not the cause of our current economic downturn. However, it is making the recovery a lot harder because resources are not being freed to go where the private sector would have otherwise put them. The culprit of the current economic crisis is Federal Reserve System and our fractional-reserve banking system.

Big Government can, however, bankrupt us, which is why many economists in the Austrian School (and some outside, I guess) believe that a "Great Default" is coming.

Saturday, November 6, 2010

Gordon on Economic Growth in Light of Theory

"The basics of Austrian cycle theory fall readily into place once one considers a fundamental point: the economy can grow only by producing more goods. An expansion of the money supply does not suffice. Efforts to get something for nothing, by the government's deficit spending or by an expansion of the money supply, cannot produce lasting prosperity." David Gordon

The Necessity of Public Support of Free-Markets

"If the public does not understand the economics of depression, there is little hope that we can avoid disastrous government policies. Unless the free market receives sufficient popular support, our economic future is bleak." David Gordon

Thursday, November 4, 2010

Book: The Revolution That Wasn't

"It is my contention that conservatives who think the Republican Party is the party of conservatism are mistaken, Christians who think the Republican Party is the party of God are deceived, and anyone who thinks the Republican Party is the lesser of two evils is ignorant" -Laurence M. Vance, The Revolution That Wasn't

With descriptions like these, I wonder what is on the inside!

Wednesday, November 3, 2010

Video: 3 Reasons This Election Didn't Change A Thing

This video is absolutely essential for the Tea-Party movement and indeed all Americans to see and understand.

My Three Reasons for Believing This Election Won't Change Anything

1. No one is talking about the needless and titanic American war-machine in the Middle East.

2. The Republican Party still is the party of war and unnecessary defense spending.

3. Oh, and the economy is still in the toilet and the Republicans don't have a clue as to how to let the market correct it.

(Notice I didn't say the Republicans didn't know how to "fix" it - as if the Republicans were a bunch of Mr. Fix Its with tools in hand, smiles on faces, and a blueprint to lay down the groundwork for the economy. No. If I said that, that would make them central planners.)

Humor: Is Obama A Keynesian? Rally For Sanity, 10/30/10

P.J. O'Rourke on Democrats

Tuesday, November 2, 2010

Advice to Tea Partiers

John Samples, a speaker in this video and author of The Struggle to Limit Government, has made his latest book available for free (or at least the Cato Institute has). To download the new book click here.

Monday, November 1, 2010

Rothbard on the National Debt

Establishment economists, including Reaganomists, cleverly fudge the issue by arbitrarily labeling virtually all government spending as "investments," making it sound as if everything is fine and dandy because savings are being productively "invested."

In reality, however, government spending only qualifies as "investment" in an Orwellian sense; government actually spends on behalf of the "consumer goods" and desires of bureaucrats, politicians, and their dependent client groups. Government spending, therefore, rather than being "investment," is consumer spending of a peculiarly wasteful and unproductive sort, since it is indulged not by producers but by a parasitic class that is living off, and increasingly weakening, the productive private sector. Thus, we see that statistics are not in the least "scientific" or "valuefree"; how data are classified—whether, for example, government spending is "consumption" or "investment"—depends upon the political philosophy and insights of the classifier." Murray Rothbard, Repudiating the National Debt

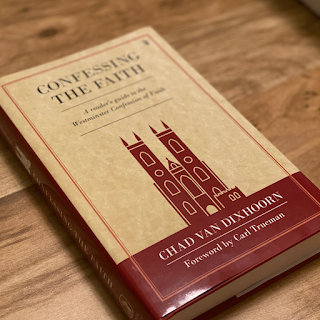

WCF Chapter One "Of Holy Scripture" Sunday School (Sept.-Oct. 2021)

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

January 12, 2012 Update: The old link no longer works. The old link is still below but the new leak is right below the old link. Thanks to t...