To recapitulate my argument from a previous article: Alan Greenspan's low-interest-rate policy in the wake of the dot-com crash spawned the housing bubble. Greenspan's Fed didn't actually eliminate the need for a recession, but instead postponed the crisis and made it fester. When reality hit in September 2008, Ben Bernanke was in charge of the Fed and implemented his predecessor's failed approach times ten.Why Is the Stock Market Plunging? - Robert P. Murphy - Mises Daily

Monday, August 8, 2011

Why Is the Stock Market Plunging? - Robert P. Murphy - Mises Daily

Subscribe to:

Post Comments (Atom)

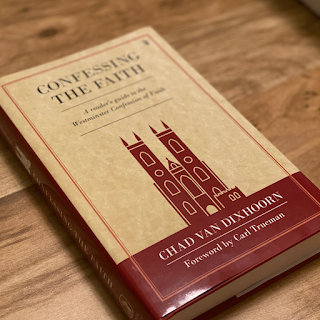

WCF Chapter One "Of Holy Scripture" Sunday School (Sept.-Oct. 2021)

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

-

January 12, 2012 Update: The old link no longer works. The old link is still below but the new leak is right below the old link. Thanks to t...

-

Our text for Sunday School (also "The Confession of Faith and Catechisms") Biblical Theology Bites What is "Biblical Theology...

No comments:

Post a Comment